Bubbles are a controversial topic among economists. Robert Shiller, the academic most prominently associated with bubbles, shared this year’s economics Nobel Prize with Eugene Fama and Lars Peter Hansen. In a 2010 New Yorker interview, Fama denied the meaningfulness of the very concept of bubbles. The related concept of value is less controversial among economists, but economists’ shared understanding of value can seem strange (and perhaps offensive) to non-economists. A discussion of the value of the digital currency Bitcoin may shed some light on both of these concepts.

When you buy Bitcoins, what you’re paying for is an entry in a digital ledger. Each of the millions of computers running the Bitcoin software has a copy of this ledger, which now takes up more than 12 gigabytes of storage space. However, there is no central authority that promises to redeem Bitcoins for anything else. It’s therefore pretty remarkable that people are indeed willing to pay for Bitcoins.

The obvious retort is that the same could be said for the conventional currencies that people use to buy Bitcoins. Although the digital entries in people’s bank accounts can be redeemed for paper currency, the paper itself is not very valuable. In the financial year 2012/13, it cost the Bank of England just £40 million to produce 760 million banknotes—an average of about 5p per note. This means UK banknotes are currently worth between 100 and 1,000 times as much as the paper they’re printed on.

These impressive ratios do not survive when a government prints too much of its currency. The infamous German hyperinflation in the early 1920s led to banknotes being used as wallpaper. The possibility of such a dramatic collapse in value is what people are trying to emphasise when they describe fiat currencies as “intrinsically valueless”. Strictly speaking, however, there is no such thing as intrinsic value—at least according to economists’ definition of value.

For economists, a thing is valuable to the extent that it satisfies people’s wants. The difficulty is that different goods satisfy different wants, so there is no natural unit of value in which to compare them directly. Instead, economists measure the value of things in terms of what people are willing to exchange for them. In the language of economics, value is just another word for price or exchange rate. “Gold is more valuable than rice” is not an ethical judgement—it’s a factual claim that people will give you more dollar bills for a kilogram of gold than for a kilogram of rice (at the time of writing, more than 100,000 times as many: $38,320 vs. 34 cents). The economic test of Bitcoin’s value is therefore what people will pay for one.

In everyday life, people measure the value of things in units of their country’s currency, precisely because the vast majority of transactions involve exchanging that currency for goods or services. This is what economists mean by money serving as a unit of account and as a universally accepted medium of exchange. (The standard definition of money requires that it also serve as a store of value.)

It makes sense to call Bitcoin a currency, because like other currencies it is a financial asset that pays no interest or dividends. However, Bitcoin doesn’t yet meet the standard definition of money. A growing number of online and brick-and-mortar stores accept Bitcoin as payment, but it’s still a long way from universal acceptance. Moreover, as far as I’m aware, none of the places that accept Bitcoin set their prices in Bitcoin. Instead, they set prices in their local currency and calculate the Bitcoin total at the checkout according to the current exchange rate. If they use a payment processor like BitPay, they never even have to handle any Bitcoins themselves. As Ryan Avent has pointed out, in this sense Bitcoin is a foreign currency for everyone who uses it, meaning it isn’t a unit of account. Bitcoin’s exchange rate against other currencies has been extremely volatile so far, so it’s also a very risky way to store value.

This brings us to the question of whether there is a Bitcoin bubble. In a 2008 EconTalk podcast, Shiller defined a bubble as “an unwarranted asset price boom”. Given that economists measure the value of things by what people are prepared to pay for them, how would they judge whether an asset’s market price is warranted or not? The answer lies in what Russ Roberts, EconTalk’s host, added to Shiller’s definition: “not related to fundamentals”.

Unlike intrinsic value, fundamental value does have an economic meaning in certain contexts. The fundamental value of a company is calculated by adding up its expected future profits, with a lower weight on profits further in the future to account for people’s impatience. Similarly, economists often use housing rents as a reference point for assessing whether houses are over- or under-valued. However, for many assets, such reference points are hard to come by, and I believe this explains much of the disagreement over bubbles.

What, if anything, might pin down the fundamental value of Bitcoins? I agree with Timothy Lee that Bitcoin is less likely to replace conventional currencies than to coexist alongside them as a platform for financial innovation. Bitcoin has lower transaction fees and much greater potential for anonymity than existing electronic payment systems. However, as Megan McArdle points out, much will depend on whether governments clamp down on Bitcoin exchanges to limit Bitcoin’s use for illegal purposes such as gambling, buying drugs and evading capital controls.

In the podcast, Shiller goes on to note that bubbles are defined by the fact that they burst. By my reckoning there have been at least three major increases in the dollar value of Bitcoin so far—each completely dwarfing the previous one, and each followed by a sharp decline.

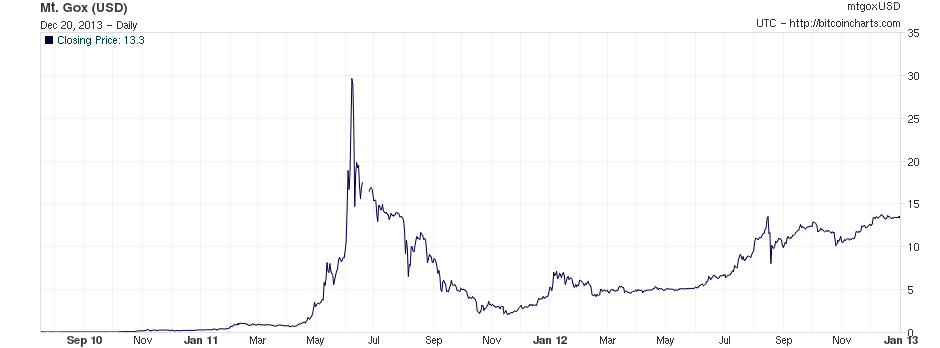

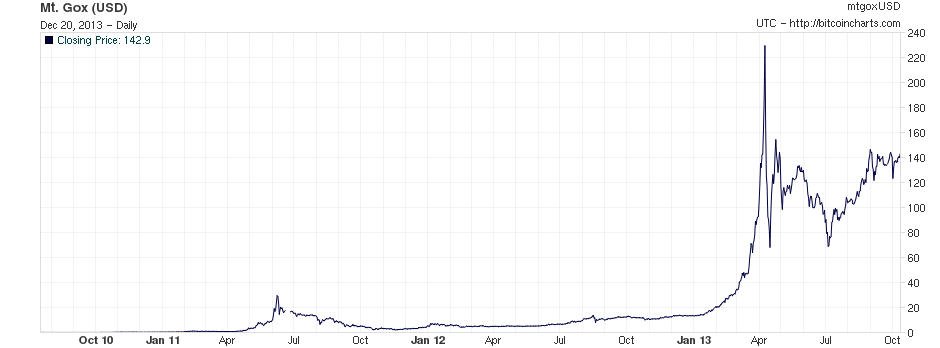

The earliest data for the US dollar/Bitcoin exchange rate comes from the Mt Gox exchange, going back to July 2010. In the first three months of trading, Bitcoin fluctuated between 5 and 10 cents, but by the end of the year it had reached 30 cents. The first huge spike (and the only one that still shows up on charts that include today’s price) began in late April 2011, with Bitcoin hitting a peak of around $30 on 8 June before crashing below $15 just three days later. By the end of the year, Bitcoin was down below $5 again. The first half of 2012 was uneventful by Bitcoin standards, but the price took off again after May, climbing above $13 by the end of the year.

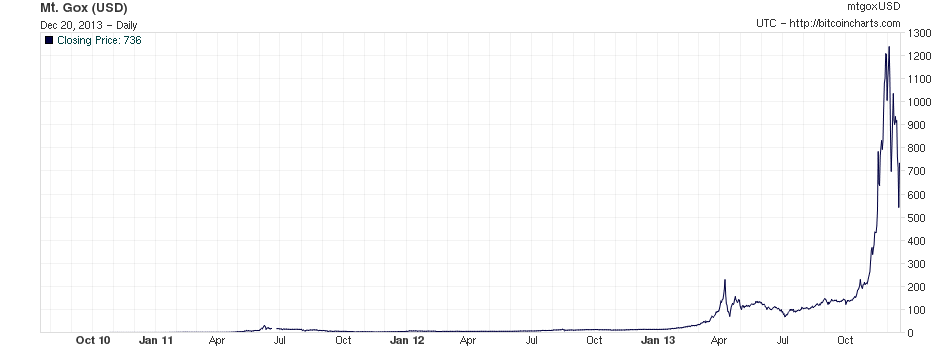

Bitcoin quickly gathered momentum in early 2013 and exploded in late March, hitting a peak price of $266 on 10 April before plunging to $50 over the course of the following week. (For visual clarity, I’ve plotted the closing price, so intra-day peaks and troughs don’t show up on the graphs.) By early October, the price had recovered to around $125, and by the end of the month it was around $200.

November and December of 2013 have been Bitcoin’s most dramatic months so far. 29 November saw the highest price paid for a Bitcoin on Mt Gox to date: $1,242—within $12 of the symbolic threshold of the price of a troy ounce of gold that day. The Bitcoin price has been extremely volatile since then, dipping to a low of $455 on 18 December. At the time of writing, the price was around $700.

A lesson to be drawn from Bitcoin’s history so far is that bubbles are relative. A speculator who bought at the April 2013 peak and sold at the (current) December trough would still have roughly doubled his money. Still, anyone hoping to get in on the next Bitcoin bubble should heed the message for which Fama was awarded his share of the Nobel Prize: short-run asset price movements are extremely unpredictable.